Scope of Work:

Commercial Mass Appraisal Valuation (CMAV) is the process of developing equal and uniform market values for all commercial improved and vacant property for ad valorem purposes located inside the jurisdictional boundaries of the appraisal district. The members of district staff which will be involved in the valuation of multifamily income producing properties include: the Appraisal Director, commercial staff appraisers, and any other staff member deemed appropriate by the Chief Appraiser.

The fee simple interest of commercial real property is appraised as required by state statute. The effect of easements, restrictions, encumbrances, leases, contracts or special assessments are considered on an individual basis, as is the appraisement of any non-exempt taxable fractional interests in real property (i.e. certain multi-family housing projects). Fractional interests or partial holdings of real property are appraised in fee simple for the whole property and divided based on their pro-rata interests.

The commercial valuation function is divided into five improved property valuation groups and a vacant commercial land group. Summarized as:

- Multi-family (Apartments)

- Office

- Retail

- Warehouse

- Special Use Commercial: (i.e. hotels, hospitals and, nursing homes).

Highest and Best Use Analysis:

The highest and best use must be physically possible, legal, financially feasible, and productive to its maximum potential. The commercial appraisal staff will conduct a highest and best use analysis of commercial property to ensure the current use of property supports the highest present value as of the date of the appraisal. The highest and best use of commercial property is normally its current use. Commercial Valuation undertakes reassessment of highest and best use in transition areas and areas of mixed residential and commercial use. Adjustments to the property value is made via changes in land classification or adjustments factors; improvement adjustment factors or classification code; or a combination of land and improvement adjustments are made in order to properly appraise the subject property at market value. Highest and best use analysis is used to confirm the accuracy of the market value estimate which approximates market price under the following assumptions: (1) no coercion of undue influence over the buyer or seller in an attempt to force the purchase or sale, (2) well-informed buyers and sellers acting in their own best interests, (3) a reasonable time for the transaction to take place, and (4) payment in cash or its equivalent.

Area Analysis:

Data on regional economic forces affecting the valuation of real commercial property values will be collected from various public, professional, and private sources by the Commercial Department Manager and appraisal staff. This information is used in neighborhood analysis and calibration of economic factors.

Neighborhood Analysis:

Properties of common traits are grouped into geographic groupings or “neighborhoods” which share similar and uniform physical, economic, governmental and social forces. The neighborhoods are smaller, manageable subsets of the universe of properties. Each commercial neighborhood is assigned to a neighborhood group (NBF) based on observable aspects of homogeneity between neighborhoods. Neighborhood analysis will be performed to examine how these forces influence property values. these forces influence property values.

Market Analysis:

Market analysis relates directly to market forces affecting supply and demand. This study involves the relationships between social, economic, environmental, governmental, and site conditions. Current market activity including sales of commercial properties, new construction, new leases, lease rates, absorption rates, vacancies, allowable expenses (inclusive of replacement reserves), expense ratio trends, and capitalization rate studies will be analyzed. Local consultation with area real estate professionals will be utilized to lend support to the various assumptions utilized in the valuation of real estate.

Categorization:

In addition, commercial properties are also grouped into like-use categories which reflect similar property use. Use type categories are further divided into sub-categories based on quality, function, and economic factors such as percentage of occupancy, amenities, etc., as determined by commercial appraisal staff. These rankings are recording within the valuation record as an alpha designation of type “A”, “B”, “C”, and “D.” Additional sub-categorization may be utilized by the commercial appraisal department as deemed necessary to maintain consistency and uniformity in property use classification.

Field Inspection Procedures:

Appraisers of the Midland Central Appraisal District shall inspect the exterior of each structure. Interior data shall be obtained through on-site inspection or personal interviews when possible. Construction features, characteristics, appendages, accessory buildings or irregularities for each property shall be recorded on field worksheets or portable computers. Grade classification shall be distinctly considered and state appraisal classification guidelines followed for each commercial building. Periodic inspections of work of all appraisal personnel shall be made by the commercial department manager in the grading (or classifying) of structures to insure correct, uniform, and consistent grade classification use. A perimeter sketch of each commercial building will be drawn on the field worksheet or in portable computer and all necessary dimensions and identification symbols shall be placed on this sketch. Appendages such as covered porches, parking garages, etc. shall be carefully shown with dimensions and labeled accordingly. All other pertinent appraisal information will gathered and recorded.

Commercial Inspection Specifications:

Staff appraisers will be assigned to designated areas in Midland County for the purpose of commercial property inspection. Each appraiser will be given the responsibility to visually and/or physically inspect each commercial property within their assigned area. The appraiser will conduct “walk-through” inspections for commercial business property when passive inspections are inadequate; such as office buildings and or enclosed shopping centers. Inspections will include both passive and active inspection activities depending on the property requirements. Passive inspection is performed by on-site visual inspection and/or by utilizing oblique aerial images, (i.e. Eagleview Imagery). Active inspection includes either physical observational walk-through; on-site measurement; on-site counting; person-to-person interviews with owners, managers, or agents of the property; or a combination thereof.

Data Collection and Validation:

Specific market data is gathered and analyzed including sales of commercial properties, new construction and other permit activity, new leases, lease rates, absorption rates, vacancies, typical property expenses (inclusive of replacement reserves, if recognized by the market), expense ratio trends, and capitalization rate indicators. This data is used to determine market ranges in price, operating costs and investment return expectations. In addition, the commercial appraisers will include verified sales of vacant land and improved properties and the pertinent data obtained from each (sales price levels, capitalization rates, income multipliers, equity dividend rates, marketing period, etc.). Other data used by these appraisers includes actual income and expense data (typically obtained through the hearings process), actual contract rental data, leasing information (commissions, tenant finish, length of terms, etc.), actual construction cost data, and in-house surveys. In addition to the actual data obtained from specific properties, market data publications will be reviewed to provide additional support for market trends such as the Chamber of Commerce for market data on apartments, retail, office, and industrial properties.

Other data sources include TREPP Database by DMGT, Texas State Comptroller Hotel /Motel Report, Institute of Real Estate Management (IREM) rental property surveys, ALN Apartment Data and various web sites from real estate professionals. Trade publications such as the Appraisal Institute’s (AI) Appraisal Journal and The Journal of Property Tax Administration from the IAAO will be used for research of appraisal methodology, capitalization rate development, and other pertinent real estate appraisal technical information.

In terms of commercial sales data, MCAD receives a copy of the deeds recorded in Midland County that convey commercially classed properties. The deeds involving a change in commercial ownership will be entered into the sales information database and researched to obtain the pertinent sale information. For those properties involved in a transfer of commercial ownership, a sale file is maintained which begins the research and verification process. The initial step in sales verification involves a computer-generated questionnaire that is mailed to the transaction grantee. If a questionnaire is answered and returned, the documented responses are recorded into the computerized sales database system. If no information is provided, verification will then be attempted via phone calls to both parties. If the sales information is still not obtained, other sources will be contacted such as the brokers involved in the sale, property managers or commercial vendors. In other occasions sales verification is obtained from local appraisers or others that may have the desired information. Finally, closing statements are often provided during the hearings process. The actual closing statement is the most reliable and preferred method of sales verification. After the sales data has been keyed into the database, the data will be reviewed to maintain quality control. This sales information will be used for informal and formal valuation reviews.

The Cost Approach:

Commercial Application of Cost Approach:

The cost approach to value will be applied to all improved real property utilizing the comparative unit method. The district will utilize national cost data reporting services as well as actual cost information on comparable properties whenever possible. Cost models will be developed and updated based on the Marshall Swift Valuation Service. Cost models will include the derivation of replacement cost new (RCN) of all improvements which will include comparative base rates, per unit adjustments and lump sum adjustments. The sales comparison approach will be used in the valuation of the underlying land value. Time and location modifiers will be used as necessary to adjust the cost data in order to reflect market condition changes in costs over time. Because a national cost service is used as a basis for the cost models, location adjustment modifiers will be used to adjust these base costs specifically for Midland County. The national cost service provides these modifiers. Resulting base values will be input into the district’s CAMA system. Depreciation schedules will be developed and updated based on typical factors for each property type at that specific age. Depreciation schedules will be implemented for each major class of commercial property by economic life categories. Schedules will be updated for improvements with 15, 20, 30, 40, 50, and 70 year expected life. These schedules will be tested to ensure they are reflective of current market conditions. The actual and effective ages of improvements will be noted in CAMA.

Effective age estimates will be updated based on the utility of the improvements relative to where the improvement lies on the scale of its total economic life and its competitive position in the marketplace. Effective age estimates will be based on personal inspection and analysis by staff commercial appraisers. Market adjustment factors such as economic and or functional obsolescence will be applied as warranted. A depreciation calculation override will be used if the condition or effective age of a property varies from normal market conditions.

Cost Model Description:

The Midland Central Appraisal District’s commercial cost valuation model is a hybrid cost-sales comparison approach technique. Adjustment factors including: Neighborhood adjustment factors (NBF), functional obsolescence factors (FD), and economic obsolescence factors (ED) are used to modify base cost estimates and to ensure that estimated values are consistent with the market. This type of approach accounts for internal and external value influences not specified in a pure cost model. The following equation denotes the hybrid model used:

MV = [( RCN – D ) ( 1 + FD) ( 1 + ED ) (NBF + 1)] + LV

Whereby; the market value (MV) equals the replacement cost new (RCN) less depreciation (D) multiplied by the functional (FD) and economic (ED) adjustment factors, the result of which is multiplied by the neighborhood adjustment factor (NBF) thus composing the final improvement value, where by the land value (LV) is added to complete the total property value. Once all adjustments factors are input into the district’s CAMA system, recalculation of property valuation is performed either on individual accounts or on a mass basis in order generate final valuation.

The Income Approach:

Description: The income approach to value will be applied to commercial real properties which are typically viewed by market participants as “income producing”, and for which the income methodology is considered a leading value indicator.

Application of Income Approach:

An estimation of market rent on a per unit basis will be made. This value will be derived primarily from actual rent data furnished by property owners, from local market study publications, and as available from TREPP LLC. database subscription service. This per unit rental rate will be multiplied by the number of units resulting in an estimate of potential gross rent. Next, projected vacancy and collection loss allowance will be estimated from actual data furnished by property owners and district market surveys. This allowance accounts for periodic fluctuations in occupancy, both above and below an estimated stabilized level. The market derived stabilized vacancy and collection loss allowance will then be subtracted from the potential gross rent estimate to yield an effective gross rent.

A secondary income or service income will be calculated as a percentage of stabilized effective gross rent and or actual data supplied by property owners and agents. Secondary income represents parking income, escalations, reimbursements, and other miscellaneous income generated by the operations of real property. The secondary income estimate is derived from actual data collected and available market information and will be added to the effective gross rent (EGR) to arrive at an effective gross income (EGI).

Allowable expenses and expense ratio estimates will be based on a study of the local market, with the assumption of prudent management. An allowance for non-recoverable expenses such as leasing costs and tenant improvements will be included in the expenses. A non-recoverable expense represents costs that the owner pays to lease rental space. Different expense ratios will be developed for different types of commercial property based on use. Actual expense data for the subject property will be used when available for analysis and confirmation of model estimates. Expense ratios will also be implemented as needed based on the type of commercial property. Allowable expenses will be considered for the replacement of short-lived items (such as roof or floor coverings, air conditioning or major mechanical equipment or appliances) requiring expenditures of large lump sums. These capital expenditures, known as replacement reserves, will be analyzed for consistency and adjusted. They may be applied on an annualized basis as stabilized expenses when warranted. Expenses (inclusive of non-recoverable expenses and replacement reserves) will be subtracted from the effective gross income yields to arrive at an estimate of net operating income (NOI).

Rates and multipliers, such as overall capitalization rates, discount rates, and income multipliers, will be used to convert income into an estimate of market value. Each of these is used in specific applications. Rates and multipliers will vary between property types, as well as by location, quality, condition, design, age, and other factors resulting from a thorough analysis of the market. All commercial properties being valued via the income approach are internally coding in the district’s CAMA software system.

Capitalization Analysis and Techniques:

Capitalization analysis is used in the income approach models. This methodology involves the capitalization of net operating income as an indication of market value for a specific property. Capitalization rates, both overall (going-in) cap rates for the direct capitalization method and terminal cap rates for discounted cash flow analyses, can be derived from the market. Sales of improved properties from which actual income and expense data are obtained provide a very good indication of what a specific market participant is requiring from an investment at a specific point in time. In addition, overall capitalization rates can be derived from the built-up method (band-of-investment). This method relates to satisfying the market return requirements of both the debt and equity positions of a real estate investment. This information is obtained from real estate and financial publications. The following income capitalization techniques will be used to value commercial property as appropriate by type:

- Direct Capitalization: The primary yield capitalization method used for the valuation of commercial property by the district is Direct Capitalization. Direct capitalization income valuations are calculated outside the CAMA system either in MS Excel spreadsheets or MS Access databases. These valuation amounts are entered into the CAMA system as staff value change overrides designated by the internal code “D” in the computer valuation screen of the CAMA system.

The direct capitalization income valuation model is based on the formula:

MV = NOI ÷ TACR

Whereby; the market value (MV) equals to the net operating income (NOI) divided by the tax adjusted capitalization rate (TACR). Income parameters are derived from procedures as described above. The district utilizes PC based software systems to assist in these calculations.

- Discounted Cash Flow Analysis: Discount Cash Flow analysis. Discounted Cash Flow analysis is defined as “a set of procedures in which an appraiser specifies the quantity, variability, timing, and duration of periodic income, as well as the quantity and timing of reversions and discounts each to its present value at a specified yield rate.” This technique takes the future benefits or “incomes” and converts these benefits into an indication of present value by discounting each future benefit at an appropriate yield rate. The district utilizes PC based software systems to assist in these calculations.

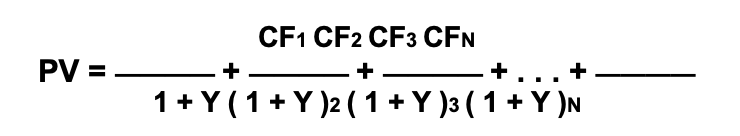

The formula is expressed as follows:

Where (PV) represents “present value”; (CF) represents “cash flow”; (Y) represents “yield rate.”

- Rent Loss Direct Capitalization: This technique will be applied to specific properties with vacancy problems which are considered short term in nature, and will be used when the appraiser concludes other yield capitalization methods are not appropriate.

- The rent loss is calculated by multiplying the rental rate by the percent difference of the property’s stabilized occupancy and its actual occupancy. Build out allowances (for first generation space or retrofit/second generation space as appropriate) and leasing expenses are added to the rent loss estimate. The total adjusted loss from these real property operations is discounted using an acceptable risk rate. The discounted value (inclusive of rent loss due to extraordinary vacancy, build out allowances and leasing commissions) becomes the rent loss concession and is deducted from the value indication of the property at stabilized occupancy. The district utilizes PC based software systems to assist in these calculations.

- Gross Income Multipliers: The Gross Income Multiplier (GIM) method shows the ratio of the commercial property sales price to its gross income and compensates for additional income generated by the property. The GIM is calculated by dividing the actual sales price of property by their reported gross income. The derived average is applied to the property being appraised by multiplying the GIM by the property’s gross income in order to arrive at an estimation of the subject market value. Care is taken by the commercial department’s management and appraisal staff to choose the appropriate income value technique for the type of property being appraised and in applying these methods in a uniform and equal way within the particular class and subclasses of commercial property being evaluated on a mass basis.

The Market Approach:

The sales comparison (market) approach is used for estimating commercial land value and for comparing sales of similarly improved properties to other commercial parcels on the appraisal roll. Pertinent data from actual sales of properties, both vacant and improved, is pursued throughout the year in order to obtain relevant information that can be used in the valuation process.

Sales of similarly improved properties are used for developing depreciation schedules in the Cost Approach, rates and multipliers used in the Income Approach, and as a direct comparison in the Sales Comparison Approach. Improved sales are also used in ratio studies allowing the appraisal staff to judge the level and uniformity of the appraised values.

- Model Specification: New specifications for cost, income, and market valuation models will be made in the reappraisal year. Model specification will involve the input of new or updated base values, rates, tables, and adjustments factors as required by the CAMA software system and other MCAD commercial valuation programs or systems. Details of which are described in previous sections of this report. System programming and software structure may be changed to more accurately reflect standardized appraisal valuation techniques or to comply with legal and professional specifications.

- Model Calibration: Income Valuation Models will be calibrated and finalized by adjusting the mass appraisal formulas, tables and schedules to reflect current local market conditions as described above. Once the models have undergone the specification process, adjustments will be made to reflect new construction procedures, materials and/or costs, which can vary on non-reappraisal years. The schedules and models are summarized in the District Appraisal Manual. This manual is provided to appraisers and is made available to the public in an “user-friendly” format.