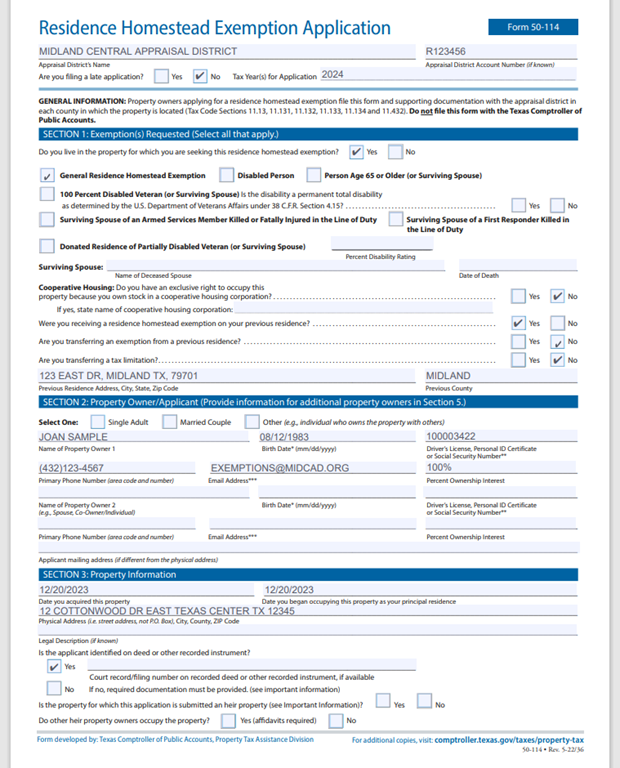

If you have questions, please call 432-699-4991 or email exemptions@midcad.org

Please read the specific requirements for each type of exemption before submitting your application. Detailed instructions can be found on page 3 of the exemption application, Form 50-114. Please read and answer all the questions.

General Residence Homestead Exemption

- You must own the property in the year you are applying for the exemption.

- The property must be used as your principal place of residence, and you may not claim an exemption on another residence homestead in or outside of Texas.

- You must submit a copy of your driver’s license. The address must match the address of the property.

- Please include your previous address in Section 1.

- Move-in Date Section 3.

Social Security Disability

- You must own the property in the year you are applying for the exemption.

- You must submit a copy of your driver’s license. The address must match the address of the property.

- You must submit the Social Security Award letter showing the start date of your disability.

Person Age 65 or Older

- You must own the property in the year you are applying for the exemption.

- You must submit a copy of your driver’s license. The address must match the address of the property.

100 Percent Disabled Veteran

- You must own the property in the year you are applying for the exemption.

- You must submit a copy of your driver’s license. The address must match the address of the property.

- You must submit the Service award letter from the Veterans Administration showing the start date of the 100% disability.

Under 100 Percent Disabled Veteran

- Form 50-135

- You must own the property in the year you are applying for the exemption.

- You must submit a copy of your driver’s license. The address must match the address of the property.

- You must submit the Service award letter from the Veterans Administration showing the start date of the under 100% disability.

Heirship Homestead